|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

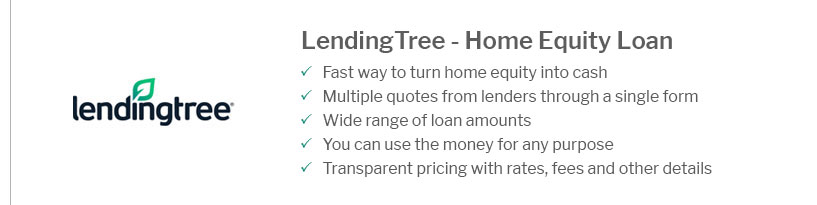

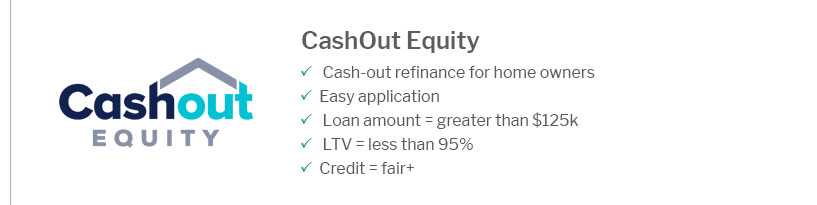

Can You Refinance Your House Twice? Exploring the PossibilitiesRefinancing your home can be a smart financial move, but can you refinance your house twice? The answer is yes, but it's important to understand the implications and benefits. In this article, we'll delve into the reasons why homeowners might consider refinancing multiple times, what to expect, and the steps involved. Why Refinance More Than Once?There are several reasons why you might consider refinancing your home more than once. These include changes in interest rates, improved credit scores, or the need to tap into home equity. Interest Rate ChangesIf interest rates have dropped since your last refinance, you might be able to secure a lower rate and save money on your mortgage payments. Improved Credit ScoreA better credit score can qualify you for better terms. If your credit has improved since your last refinance, it may be worth exploring new options. Accessing Home EquityRefinancing to access your home's equity can provide funds for home improvements or other expenses. This is often referred to as a cash-out refinance. Steps to Refinance Your Home Again

Potential DownsidesWhile refinancing multiple times can be beneficial, it's important to be aware of potential downsides.

FAQs on Refinancing Your Home TwiceHow soon can I refinance my home again after the first time?Most lenders require a waiting period of six months from your last refinance. However, it's best to check with your lender for specific guidelines. Are there costs associated with refinancing twice?Yes, each refinancing typically incurs closing costs. It's essential to weigh these costs against the potential savings. Will refinancing twice affect my credit score?Refinancing can have a temporary impact on your credit score due to hard inquiries, but it usually rebounds after a few months. Understanding the reasons and implications of refinancing your house twice is crucial for making informed financial decisions. Whether it's securing a better rate or accessing equity, refinancing can be a valuable tool. For those in specific regions, considering local factors like missouri refinance rates may also be beneficial in your decision-making process. https://www.creditkarma.com/home-loans/i/how-often-can-you-refinance

Legally speaking, there's no limit to how many times you can refinance your mortgage, so you can refinance as often as it makes financial sense for you. https://finance.yahoo.com/personal-finance/mortgages/article/how-often-can-you-refinance-your-home-185933715.html

Yes, refinancing your mortgage multiple times could temporarily affect your credit score as refinancing is considered to be a credit application ... https://www.rocketmortgage.com/learn/how-often-can-you-refinance-your-home

Legally, there isn't a limit on how many times you can refinance your home loan. However, mortgage lenders do have a few mortgage refinance requirements.

|

|---|